We build, scale &

exit SaaS ventures.

We build, scale &

exit SaaS ventures.

A venture studio that doesn't just invest. We roll up

our sleeves and build alongside founders, turning

innovative ideas into category-defining companies.

A venture studio that doesn't just invest. We roll up

our sleeves and build alongside founders, turning

innovative ideas into category-defining companies.

We've helped founders raise $500M+ through strategic fundraising and successful exits. Our team brings deep expertise in SaaS valuations and deal structures.

And scale your audience

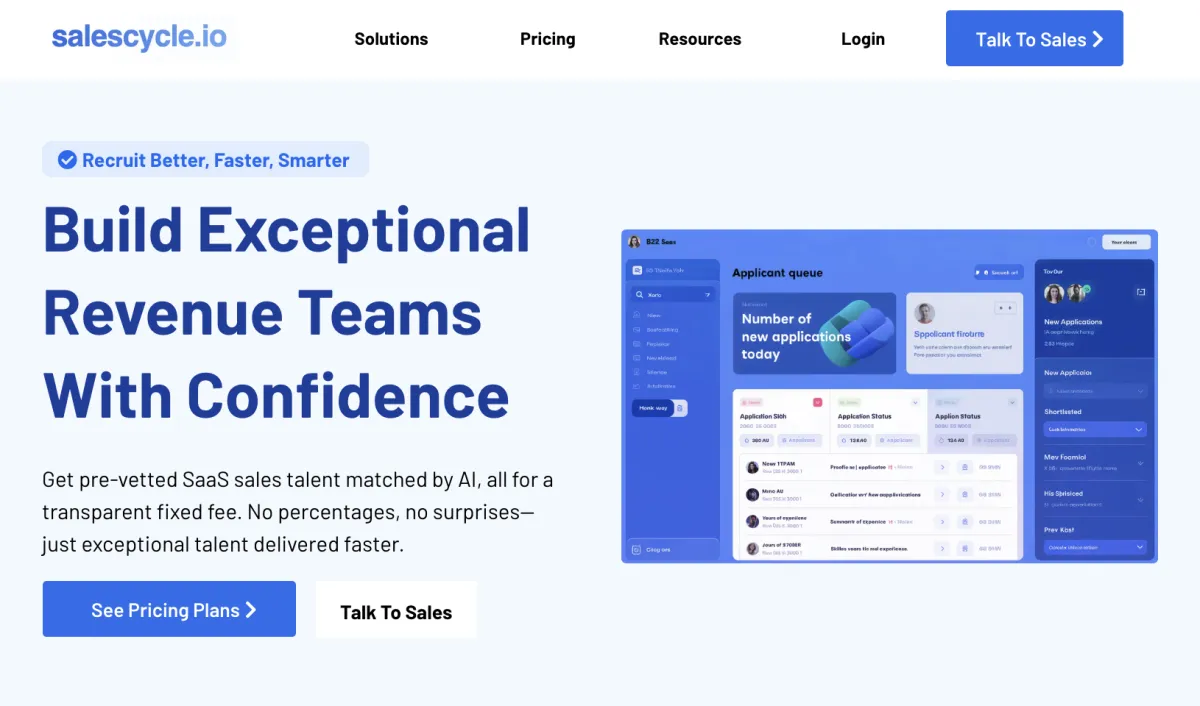

Current SaaS project(s)

Let's build, grow

& exit— together.

Build, grow &

exit— together.

Studio Ideation

We develop and validate new venture concepts

using our proven framework and market insights.

Co-Building

Partner with experienced founders to launch &

scale ventures with shared resources and risk.

Growth Strategy

Data-driven approaches to product-market fit,

fundraising, customer acquisition, and scaling.

Exit Planning

Strategic guidance and preparation for

successful exits and acquisitions.

Have an amazing SaaS idea?

We're looking for ideas that are going to disrupt our industry.

For the right partner, we'll roll up our sleeves and support

your growth in exchange for equity in your company.

We're looking for ideas that are going to disrupt our industry. For the right partner, we'll roll up our sleeves and support your growth in exchange for equity in your company.

For investors:

Top Exits delivers unparalleled expertise in capital raising and M&A. Our seasoned team transforms complex transactions into streamlined processes, leveraging deep market insights and an extensive network of qualified investors to maximise your company's value. We prioritise confidentiality, employing rigorous protocols to safeguard sensitive information throughout every deal.

Whether you're seeking growth capital or planning an exit, Top Exits ensures optimal outcomes by conducting thorough market analyses and utilising industry benchmarks to address undervaluation concerns. We craft bespoke solutions aligned with your strategic goals, minimising operational disruptions whilst securing the most advantageous terms.

Investor Network

Access our vast network of over 10,000 qualified investors, family offices and private equity funds actively seeking opportunities in online businesses.

Deal Structuring

Our team brings hands-on experience

in building, managing, and selling digital assets, ensuring expert guidance throughout the process.

Ongoing Support

We offer continuous advisory

services post-investment to help maximise value and drive growth

in your portfolio companies.